Your credit score direct affects your finances. In addition to determining how much you will be paying in interest on a loan for your car, home, or even a credit card; a good score may even get you lower car insurance rates. Looking for a new job? Some companies will check your credit report, especially if you work with money at all.

However, your credit score is composed of lots of information, and with all of that, there is a chance of there being an error. Luckily you can get a free credit report from the big agencies, once a year. Now if you search for “free credit report” you’ll get a lot of sites. However, https://www.annualcreditreport.com/ is the official free site as part of the Fair Credit Reporting Act.

As part of my new year routine, I like to get them in January. Even if I don’t plan on making a large purchase in the next month, I want to be ready. It’s also a good first step if one of your new years resolutions is to improve your finances. Whether it be to save for a new house, pay down a credit card, etc. (A higher credit score can get you a lower interest rate on a credit card, making paying it down easier.

Unfortunately, about every other time I check, I see an error. Hopefully you won’t, but if so, lucky for you, it isn’t too difficult to fix the errors.

So here are the steps to check and see if you have an error.

- So go to annualcreditreport.com.

- Enter the information needed to verify who you are. This will include your:

- Full Name

- Address (previous address if you’ve liver their less than 2 years)

- Social Security

- Date of Birth

- Request the reports you want. I always select all three, but you don’t have to if you don’t want to.

- Review the reports.

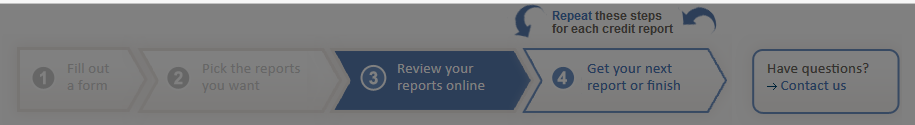

When you get done, you’ll see a screen like below which will take you through the different reports:

What should you check in your report?

There are a few things I always check.

First, I check for errors in the credit statements. The two most important include:

- Past due notices when they were not? Sometimes things don’t get reported, its important to fix these late payments will hurt your credit score. If you were past due, there is little you can do other than work on not continuing to have these.

- Any extra accounts showing up? This has happened a couple of to me, usually from someone with a similar name, or who lived at the same address that I used to. I’ve caught a credit card which had over $30,000 used on it, and a property lien. This is also important to check to see if someone has opened an account in your name, in which case you are a victim of credit fraud.

- Are closed accounts showing correctly? Did you pay off a student loan? The mortgage when you sold your house? These should be shown as closed.

Don’t worry if your credit used on your card isn’t showing, or that you paid off last months credit card. That info may not have been sent in to the credit reporting company yet, they do not update in real-time.

It’s important to know that each company reports data differently. Some will use just text, others will use color coded tables. Luckily they provide a key for you:

Hopefully yours is all green. The further down the list in this key, the worse. Try to avoid getting there if possible.

The next thing I look at is credit inquiries. When a person or company contacts one of the credit reporting companies they record it. Generally someone will go to one, but rarely all three, so this will be different for each report. Some checking is normal. For example when you go to get a loan (to buy or lease a car, rent a home), apply for a job, or a few other special cases. However, you should know when this someone is requesting a look.

If you look and see companies checking your credit, and you didn’t apply for them, someone may be attempting to steal your identity. You may think you don’t have anything, so it’s not a big deal, but it can follow you around for years, and it is worth investigating with a professional if you think it might be a real problem.

Finally I review personal information. This will include things like current address, other known names, etc. Each reporting company may offer different details in different ways, but that’s OK. Reviewing, and correcting, what you need to reduces the chances of future mistakes.

What’s not in your report?

The one thing you don’t see in your report is what your credit score is. This is not required by the FCRA. You can buy this from the companies if you want, and they will attempt to sell it to you. However, you are under no obligation to get it, so don’t worry about trying to.

While you’ve seen what goes into your score, you won’t know the number unless you order it. Luckily there are ways to get your score for free if you want/need it.

Credit monitoring/protection is not included either. The report allows you to manually review your report. It does not protect you, or monitor it for you. Please keep this in mind. If you don’t see any red flags in your report, you can probably skip it. If you do see it, then you might want to look into a service which can help.

As the new year comes, many people look to setting new years resolutions to make changes in their life. Almost of a third of people who make resolutions do so about weight. Over 40% of people make resolutions about money.

As the new year comes, many people look to setting new years resolutions to make changes in their life. Almost of a third of people who make resolutions do so about weight. Over 40% of people make resolutions about money.